One of the things I’ve always wanted to do is purchase an online business bringing in at least $1,000 per month and then try to optimize and grow it.

I figured my three main skill sets of copywriting, SEO, and content marketing would be a great fit for this type of endeavor, and then I could look to either resell it at a higher price or simply retain the monthly cashflow as income.

This is not that story.

Instead, this is the story of how I spent $60,000 to buy a 7-year-old recipe blog instead of making a similarly priced real estate investment… and then did absolutely nothing to it… much the same as I would have treated a real estate investment.

Here’s what happened.

The Real Estate Strategy & Why I Decided Against It

If you saw my tweet, which prompted this writeup, I actually misremembered the price of the real estate purchase I was considering.

After looking it back up, the property I was looking at buying was a $27,900 home with existing renters at $480 per month.

I was thinking about buying two properties like this in the short term, which would have brought in around $1,000 in monthly revenue, with the idea being that if I could purchase around 10 of these homes over the next decade at a combined $300,000, I’m bringing in around $5,000 per month in recurring revenue via pretty stable assets.

Not a bad strategy, and it’s one I’ll probably add in at some point. There are some clear “pros”:

- Real estate is mostly a risk-averse investment

- $30,000 is a pretty manageable periodic cash investment relative to alternatives

- No need for financial leverage (I know interest rates are low right now, but I’m a risk-averse, unsophisticated investor who believes we are in an unsustainable bubble)

- 60x cashflow-to-purchase multiplier is really good for real estate

But at the time, there were a lot of reasons I was hesitant to go this route:

- Large opportunity cost – nearly every other potential investment I was considering had much higher return potential. I’m only 30, and I have enough in my 401k already for a survivable retirement, so I didn’t feel pressure to go stable with a low return.

- Old building with high potential for repairs to eat away from already meager return.

- Property was located in a different state where I was less familiar with market/renters/local issues that might affect value.

- Real estate prices have gone up for the last 11 straight years – didn’t seem like an ideal time to buy.

- Other options sounded more fun

With this in mind, I was keeping my eye on those alternative options.

The Website Purchase Strategy

Beginning in July 2019, I set up an account with Empire Flippers and started browsing through their listings from time to time.

I chose Empire Flippers because I found the messaging about their extensive vetting process and hands-on transfer process to be really compelling. I knew that “I didn’t know what I didn’t know” coming into this, and so I liked the idea of having an experienced 3rd party provide that extra reassurance that the site numbers were legitimate.

Websites are typically priced via a cashflow-to-purchase multiplier. For example, if a site makes $1,000 per month and is selling for $30,000, that’s a “30x Multiple”. While you don’t pay a fee as the buyer, sites on Empire Flipper range from a 24x-55x multiple, which is significantly higher than what you’ll find on most other website brokers, but I felt like the additional security was worth the premium heading into my first purchasing experience.

I didn’t really know exactly what I was looking to find.

The main thing I had in mind was what I mentioned in the intro – a business bringing in $1,000 per month or more that I could optimize and grow through copywriting, SEO, and content marketing.

In order to want to commit to something like this, it would need to have a content and product focus I was personally interested in – something connected to my hobbies, existing businesses, or something I’ve been wanting to dive into.

As I looked through various listings over time, the factors and metrics I was looking for begin to take shape.

- Primarily organic traffic

- Rankings I thought I could keep

- Available monetization sources beyond Amazon affiliate

- Stable or growing traffic

- Stable or growing income

A lot of sites were driven by small-scale paid ads, and I wasn’t confident I’d be able to scale that. I wanted a solid organic base I could build on instead. Building that initial base is often the hardest and most time consuming part of building an organic-driven business, so I wanted to pay to skip that.

Additionally, a lot of sites’ top rankings seemed very vulnerable to competitors – the type of stuff they could easily rank for if they ever targeted it. That’s technically true for all rankings, but it’s more true in some niches than others.

I also didn’t want to buy into a business that could only be monetized through Amazon affiliate payouts, which seem to get lowered every other year these days. I was looking for something where I felt like I could build an email list and maybe create products or go in a few other directions.

Finding all these metrics on the same site was rare.

The vast majority of the sites that I viewed seemed to fall into two categories:

- Formerly successful businesses that had begun dying

- Relatively new sites designed to look good and sell quickly

A lot of businesses looked like they had been successful at one point but were on a steady decline the owner didn’t know how to turn around, like this five-year-old site which is currently selling for $23,000.

I was hesitant to tackle these types of sites. Over the years, I’ve seen talented SEOs struggle to right the ship when a site has fallen out of favor with Google for one reason or another, and I didn’t want to tackle that sort of challenge on my first go, unless I really liked everything else about the site.

In addition to the dying businesses, a lot of businesses looked like this one, which sold for $36,000.

This was a year-old tech review business ranking for terms that I felt were vulnerable to its much bigger competitors. I didn’t want to put myself in a position where I could get crushed the moment a bigger player targeted me, and furthermore, given the young age of the site, I felt like I could pretty easily replicate the site myself for a much lower price if I wanted to.

In other words, there was no moat, and I’d be paying a premium based on the trajectory rather than the real value of the site.

My price range was pretty limited at the time. I was only looking at sites under $100k, and since Empire Flippers is focused more on the larger sites north of six figures, the selection was relatively limited, and I didn’t find much in line with my goals during the months I was sporadically checking in.

Why I Purchased A Recipe Blog

In January, my saved cash had gotten to a point that I was feeling really irresponsible, even as an unsophisticated investor, but I didn’t want to just put it in stocks, because I felt like we were on a bubble (I know, I know).

This is when I was looking into real estate investments, and the aforementioned $27,900 home landed on my radar.

At that point, I had a pretty solid baseline to evaluate website purchases. $30,000 for $500 per month. Can I find a website deal that is superior enough to justify the additional risk?

So I decided to get a bit more aggressive about finding a website deal. I hopped on the phone with an Empire Flippers rep to talk about what I was looking for, and I wired them a fully refundable $10k that would allow me to look at the actual domains and Google Analytics behind the sites I was interested in… plus it would let me immediately purchase a site I wanted to pull the trigger on, rather than needing to wait for a wire to go through in order to secure the purchase.

They publish new listings every Monday, so I began reviewing all new listings under $100k every Monday.

I did this for about a month before finding the recipe blog that I’d end up purchasing.

If you had asked me a month before if I’d consider a food blog, I’d have said no. It wasn’t even remotely lined up with my interests or experience.

So why the recipe blog?

Simply put, the numbers were insane compared to everything else I’d looked at.

It was a 7 year old blog with a strong DA, backlink profile, and around 500 blog posts.

It was bringing in around 80k-100k visitors per month, half through organic and the other half through social and direct traffic.

And the revenue had been fairly stable for the last 3 years with barely any additional content being added to the site. There was a slight decline in the most recent year, but it was more of a “hey I need new content” decline rather than an “I’m dying” sort of decline.

The site was purely monetized through ad revenue, which had ranged from $1,400 to $2,400 per month in the previous year. It had gone as high as $3,800 two years prior, but either way, ad revenue is generally considered the least optimal form of monetization for a website, so it seemed like there was some opportunity there.

The official numbers from Empire Flipper were $1,700 net profit per month with a selling price of just over $60,000, giving it a multiple of 35x.

This was a bit higher than some of the other sites I’d looked at, and I had no desire to get into the food niche, but the revenue stability and the sheer traffic volume were what really attracted me to this listing.

Here’s what I was thinking.

- As-is, this site is bringing in twice the revenue of my comparable real estate purchase.

- If I can improve the SEO and hire out content, I make even more.

- If I can find a superior monetization strategy, I make even more.

- If I can find a talented food blogger to partner with, we’d have a really stable base to build on.

That last part is what I had in mind. I had two food bloggers in mind in my warm network who I thought would be a great fit. I know how long it takes to build this type of audience, so it seemed like taking over a brand with 100k monthly visitors would be a no-brainer.

So I decide to pull the trigger and purchase it.

Here’s What Actually Happened After I Purchased It

The moment I purchased the blog, I reached out to the first person I had in mind to partner with… and then the second shortly after.

As I said, I thought it would be a no-brainer win-win given how competitive the space is, how long it takes recipe brands to build their base, and how little traffic 95% of food blogs get.

What I hadn’t anticipated in both cases is that for each of these individuals, their work was essentially their art – a form of self-expression. And neither were interested in evolving their vision to incorporate the website assets from the brand I’d purchased.

I was a bit surprised, as I’m a compromising pragmatist, but to be honest, I respect the hell out of that.

I asked the seller if she had any people she thought would be interested in partnering with me, and she ended up sending some really incredible people my way, but we’ll pick up that thread in the next section.

The purchase went through in late February, and then we started the 30-day transfer and verification process. The idea here is that you get 30 days inside the site to verify that the advertised data was accurate before they release the funds to the seller.

I was really impressed with Empire Flippers during this process. They quarterbacked the transfer very well, and while I can see where some things could have gone poorly if the seller hadn’t been as friendly and cooperative, I don’t know that there is anything more Empire Flippers could really do in those types of situations.

My plan when getting the site at the beginning of March was just to wait and evaluate the data over the next 30-60 days before looking to make any changes.

During that 30 days, a global pandemic hit the country and I experienced the worst lower back injury of my life, where I literally couldn’t sit down for the entire month of April, and my productivity ground to a halt.

In May, my wife gave birth to our 2nd child, and the meaning of “I have no time” changed forever.

I’ve now had the site for 8 months, and I’ve done exactly nothing to it.

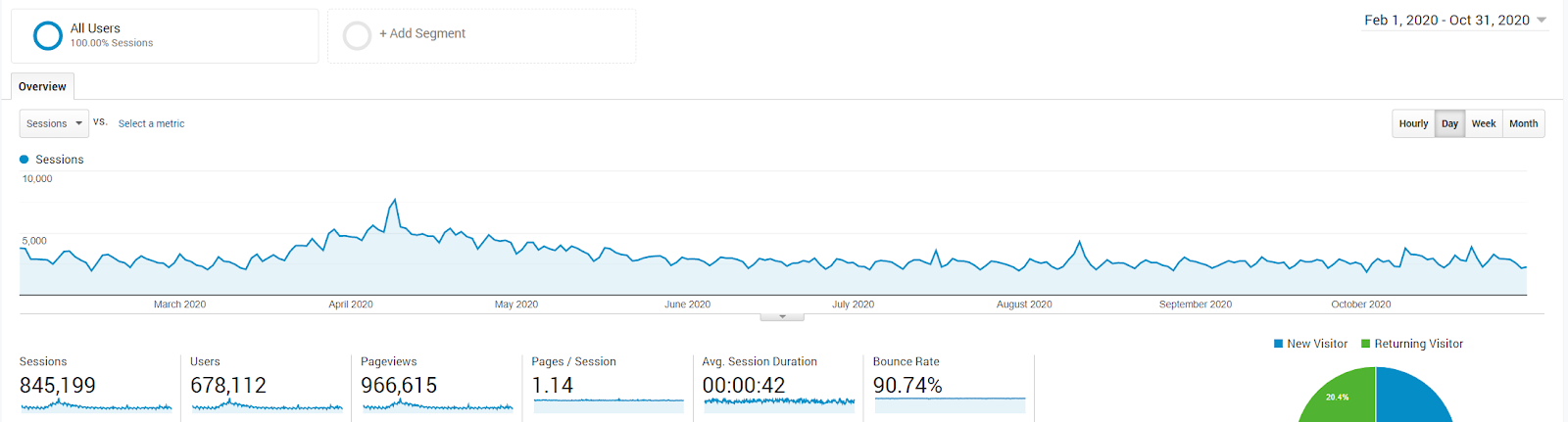

You can see the pandemic traffic spike above. The site had 150,000 sessions in April, but things eventually settled back down.

The site had 83,000 sessions in February when I purchased it and hit 86,000 this last month (October), so the stability really held out as expected.

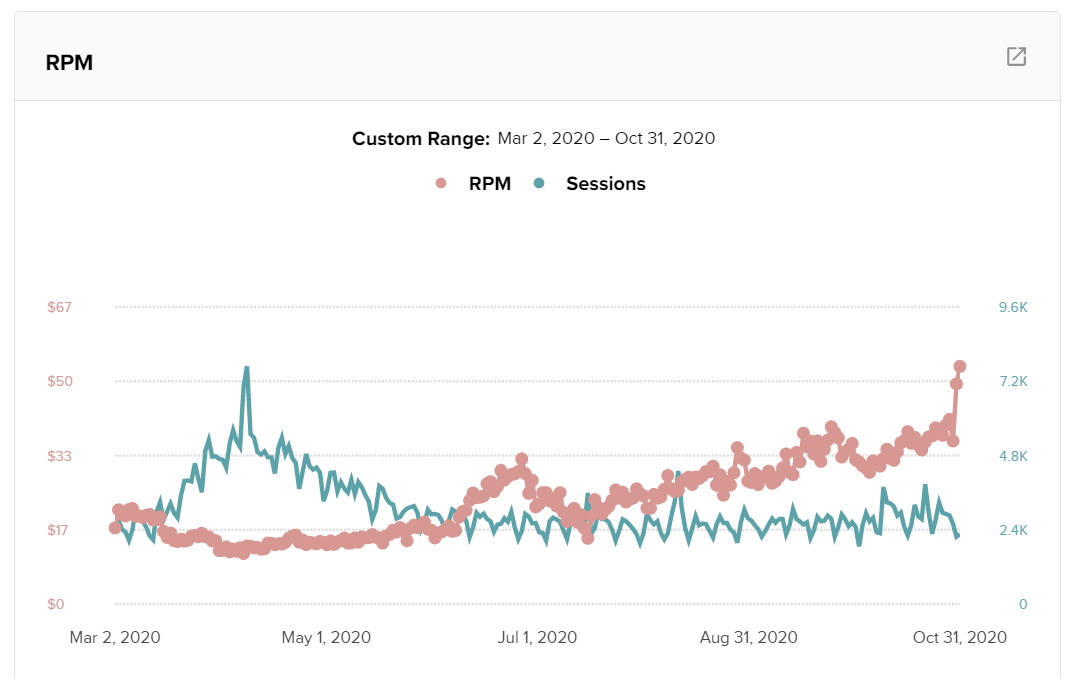

Unfortunately, RPMs plummeted during the traffic increase as advertisers pulled back on ad spend heading into Q2.

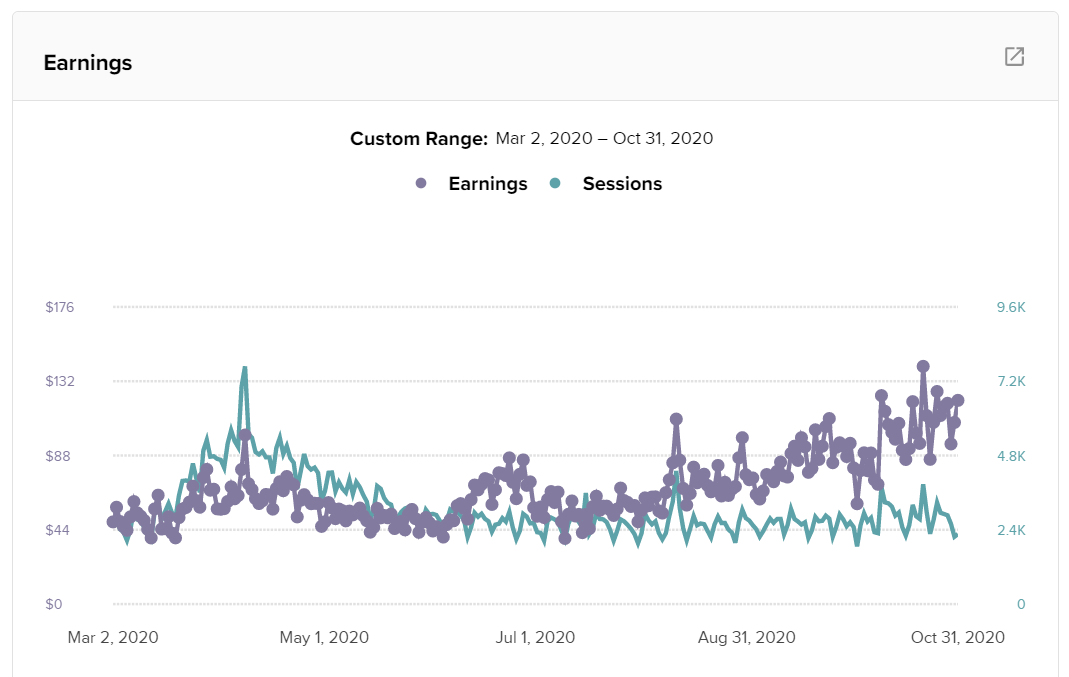

As a result, earnings remained about the same, with the traffic spike pretty much perfectly offsetting the RPM drop.

RPMs have since started to rise as they do around this time of year, and as a result, earnings have done quite well over the last 3 months, with the site breaking $3,000 in ad revenue this last month.

Ad revenue over the 8 months I’ve owned the site has averaged out to $2,092, and with Nov & Dec tending to be the strongest performing months historically for the site, there’s a reasonable chance it will finish 2020 with a $2,400 average over the 10 months I’ll have owned it.

All in all, it’s performed significantly better than two $30k home purchases would have performed over the same time period, and I haven’t had to worry about fixing air conditioners or dealing with tenants.

My Plans For The Blog In 2021

Here’s where we pick up the partner thread.

I’ve been in talks with one of the individuals the seller sent my way since February, and we are finalizing a partnership agreement as we speak with the plan being to merge brands in January 2021.

This person has a great brand of her own that is primarily built on social media, and she runs a successful media agency that creates content for sponsored campaigns run by food companies. It’s an ideal match, both in terms of assets and skills, and we’ve been really excited about this since our first meeting.

We estimate that once we merge brands and have both the blog numbers from my end and the social presence from her end, we’ll be able to do around $10k per month in brand sponsorships. From there, we’ll be working on building her longterm brand vision through a diverse content marketing strategy and a content-based product line.

I’ll be the behind-the-scenes SEO/technical/strategy guy and she’ll be the face of the brand and content driver.

There’s some risk that we’ll lose a bit of traffic in transferring the site to her domain, but the upside is more than worth the risk. Provided we are able to complete the merger by the end of January, I think this business will cross six figures in 2021 and could be a seven-figure brand by 2023, so that’s the goal.

Is that actually what’s going to happen?

Who knows… but I’ll let you know how things are looking in about a year 😀